How to Build a Fintech App that can Attract ROI

Fintech App Development: Cost Analysis, Features, and How-to Explained

A deep dive into the challenges with fintech app development, cost analysis of DIY vs. outsourcing, must-have features, considerable risks, and a step-wise guide on how to build a fintech app.

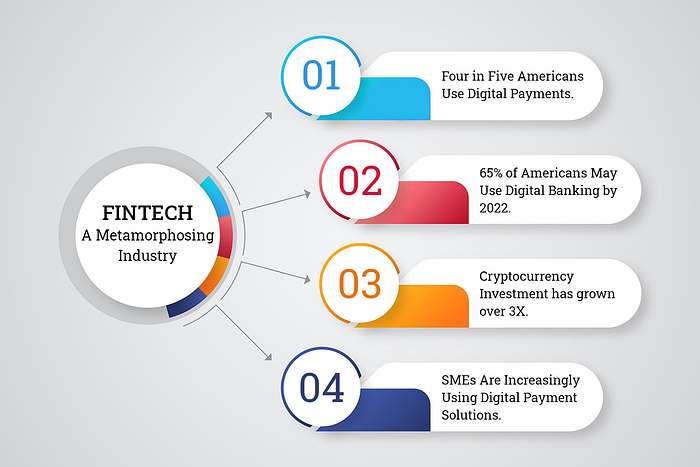

The fintech industry is worth nearly 34 billion USD. From improving customers’ digital experience to generating non-traditional revenue streams for financial organizations, fintech is everywhere.

Needless to point out, there is a load of opportunity in fintech app development at present.

However, that doesn’t necessarily mean you should start developing right away.

The fintech industry is broad; it has dimensions that are continuously evolving. Likewise, disruptive technologies in the field are emerging every day. And, the competition out there can be gauged by the fact that America has the highest number of fintech startups worldwide in 2021.

So, how to build a fintech app with a higher chance of success? Let’s get into that!

Looking into FinTech App Development? Here’s What Not to Do!

- Don’t sit down to build the next unicorn.

- Don’t expect your solution to explode in success within minutes.

There is nothing wrong with hoping for either.

Just keep in mind that a good solution solves a problem efficiently. So, you can adorn it a little. But, do not get distracted with popular solutions and invest precious time mimicking their level of appearance or finesse.

For the first release, aim for functional effectiveness.

Remember, Rome wasn’t built in a day; neither was Google Pay!

Before Anything, Comes The Idea- What Is Your Fintech App About?

You probably have an idea for the app. Maybe, you do not. It wouldn’t matter much if you let the enthusiasm blind your decisions.

Unless you understand the niche you are about to enter, the outcome will not be very fruitful.

For instance, let us assume you wish to pursue the domain of digital payments. Naturally, you would want to know all about the features of fintech app development in this niche.

But, digital payment is a category. It can branch into consumer payment solutions, mobile wallets, payment processing solutions, electronic payment accepting solutions, and so much more.

Look at the top fintech apps. Then, look at your idea or concept. Now answer:

- What exactly are you developing?

- Who is the target audience here?

- What is the end-user expecting?

- What solutions already exist?

- What can you do better?

Go into detail and research the top companies using fintech apps, year-end reviews of fintech revenue, growth, region & niche specific trends, etc. Then, prepare yourself with a clear view of the solution you want to build and the problem it will solve.

Must-Have Features of Fintech App Development

So, how to build a fintech app?

Step numero uno is the idea. Decide what you want to build and study the market for such a solution.

Number two is deciding what features are essential to make your app work.

Divide your features into two sections- essential and additional. In the former category, include every feature that a user needs for the app to fulfill its purpose. In the latter category, add features that will be nice to have.

Plan your development process around those features. Here are a few essential ones to help you along.

1. An Agreeable Fintech App Design

Gone are the days of a complicated, serious-appearing dashboard.

User convenience is a market differentiator. They want the app to work at a tap. But, they also want an aesthetic view of their activities.

Therefore, a simple and pleasing UI is one of the most essential features of fintech app development.

2. Security- The Best You Can Offer

If you ask the top companies using the fintech apps about a feature they can never compromise on, ‘security’ is likely to be the answer.

Why?

Because money matters are sensitive. Banking data, card information, emails, transaction passwords, authentication mediums- all of this is gold in the world of digital finance. Lose that data, and you will also lose your customer’s confidence and business.

Biometric is the best way to ensure security in fintech app development. Almost all mobile devices these days contain fingerprint sensors. Most also carry face ID sensors. Rely on such advanced authentication techniques.

Also, use 2FA. Two-factor authentication can eliminate up to 100% of automated cyberattacks, say Google and Microsoft.

Pick out every sensitive instance where harsh measures are a must. For example, when opening the app, validating a request for money transfer, final payment phase, etc.

3. Push Notifications

Effective communication is one of the foundational pillars of a thriving fintech application.

A user would want to know every update that a bank has to offer, or if any amount has been deducted or credited, or if there are payment offers, or if there has been any change-no matter how nominal to their account, wallet, or balance.

You will find aggressive push notifications in the top fintech apps. A user may choose to deactivate some. But as a provider, it is wise to ensure that no communication is missed.

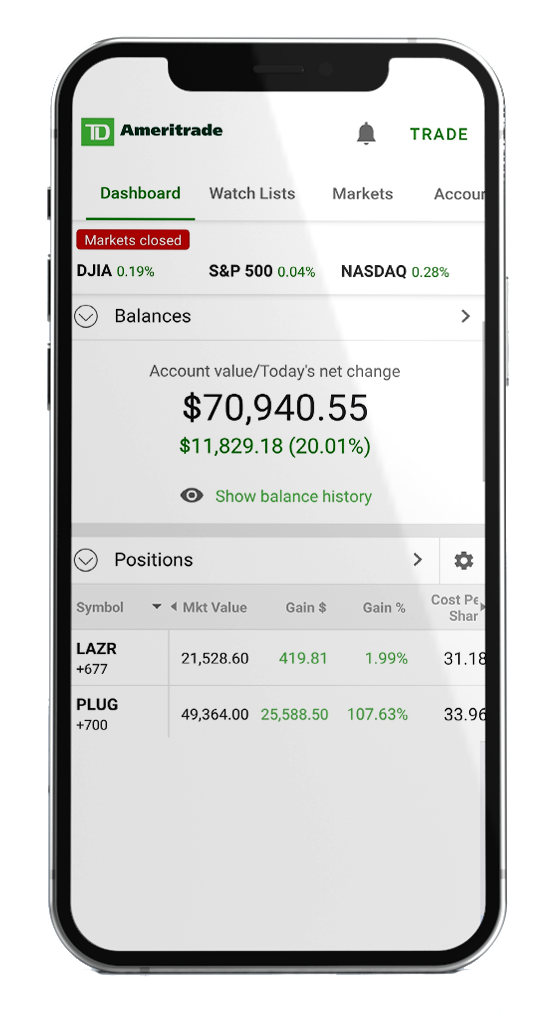

4. Analytics & Simple Reporting

Understanding financial data is a skill not everyone possesses. But, it is also a necessity. So, it is a good idea to create a dedicated reporting feature during fintech app development.

Just remember, simplicity is the key to user-friendly financial reporting.

Build an analytic feature that allows the end-user to-

Track their transactions

See detailed information on individual payments

Track data for particular accounts or ventures

Customize reports to get precise data

Export reports

If you want to walk a step ahead, throw graphical data representation in the mix. Simplify comprehension for the customers with graphs, charts, lines, bars, and captions.

5. Scanner Integration

QR codes/barcodes are an integral part of payments through the digital medium. They are identities. You will find a QR across businesses, with individual users, even small vendors.

So, if you are building a payments app, a QR code scanning integration feature is a must.

At the same time, other banking and fintech solutions can also use QR scanners. It can be used to verify documents, merchant payments, and even simple banking transactions.

Adding one will open new functional opportunities for your fintech app solution.

Risks & Challenges in Fintech App Development

With a financial ecosystem that lives on a server, the stakes are higher than ever. Unfortunately, there is no such thing as fraud immunity when you are battling to protect your users from a globe full of threats known and unknown to human intelligence.

But, there is also an opportunity here.

If you can create a safe- a relatively more secure -solution, your chances of success will multiply.

So, consider these risks when creating a wireframe of the features of fintech app development.

1. Cybersecurity

Heard of ransomware?

The cost suffered by downtime when your working app solution is held at ransom can be 10X more than the commonly demanded ransom. Plus, you will have no control over anything if the threat chooses to breach your data despite paying the ransom.

Avoiding such incidents is a matter of securing your platform.

- Employ robust protection for user accounts (think 2FA)

- Thorough testing to identify coding vulnerabilities

- Use the best anti-phishing measures

- Encrypt as much of your data as possible

- Use firewalls, antivirus, access control, etc.

We have seen how security is the choice of all top companies using fintech app services. The best mobile app development company or MVP development services will suggest a similar route to you.

2. Financial Crimes

Money laundering, fraud, illegitimate transactions- so much can go wrong when money travels online. Such financial crimes not only do away with customers’ trust but also cast a dark shadow on your business.

However, dealing with financial crimes is a high-level skill. You will need a combination of AI, constant monitoring, user behavior study, etc., to fix this matter.

At the same time, you should also utilize AI and ML to monitor suspicious behavior and handle any problems before they explode.

3. Data Encryption & Compliance

Two things here:

- Users will flock to your fintech application on the trust that their data is safe

- Thieves will flock to your data because that is where the value lies

Therefore, to keep your users satisfied and thieves away, you need to protect the data to the best extent you can.

That is where encryption and compliances come in.

Follow the best industry security standards. Encrypt the data before storing or during transit. Manage encryption keys effectively. Do your best to devalue the data so in the case it does get stolen, not much is compromised.

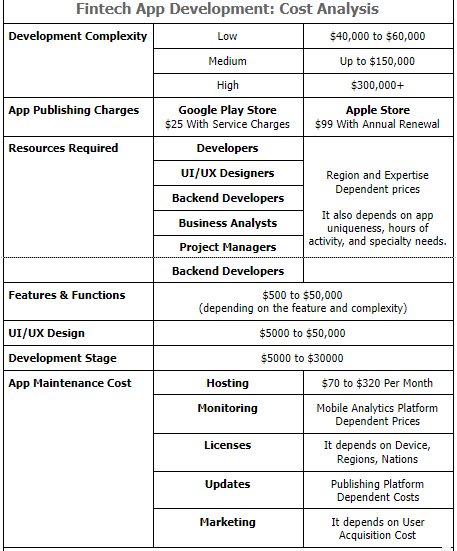

Fintech App Development: Cost Analysis

The average mobile app development cost falls in the wide range of USD30K to USD 700K.

Of course, an average value would not help you much. Ask any mobile app development company! The cost for mobile app development depends on several factors, and each of them plays a critical role in raising or lowering the final expense figure.

Then, there is the matter of building an in-house team or outsourcing MVP development services. Or you can just hire dedicated software developers for the job. The cost will differ in all three cases.

However, when you hire iOS app developers or hire Android app developers from a trusted mobile app development company, the benefits pile up.

- You get access to experienced resources.

- There is minimal monitoring needed.

- You get complete control over the process.

- The overall cost is almost always lower than recruiting an in-house team.

- Also, zero infrastructure costs

Anyhow, the fintech app development cost depends on your business model. From there, it branches into several other considerations.

So, thorough research and wise strategizing are the way to go.

Final Thoughts on How to Build a Fintech App?

While we have discussed a great deal about how top fintech apps work or what the top companies using fintech apps look for when choosing solutions, I stand by the very first statement I made.

Functional effectiveness is the key to success

How can you achieve that?

Be very clear about what you are creating. Assemble your fintech app development team with care. Hire mobile app developers after thorough screening. Choose your base-version features wisely. Create a plan to upgrade and update with proper time detentions. Follow international compliances. Eliminate risks.

Good luck with the project!

FAQ (Frequently Asked Questions)

1. How Much Does It Cost To Build A Fintech App?

Fintech app development costs vary by many factors, including development complexity, design, development, features, urgency, etc. Refer to this detailed chart to understand how the cost to build a fintech app is determined.

2. How Long Does It Take To Build A Fintech App?

You can build a fintech app in anywhere between one to ten months, depending on the complexity, uniqueness, and level of specialty you require to translate your vision into a functioning solution.

If you plan to hire dedicated software developers or outsource to a mobile app development company, you can directly ask them about the time factor. They will study your requirements and offer an estimate accordingly.

3. What Are The Legal Requirements That A Fintech App Must Comply With?

Most ‘how to build a fintech app’ guides don’t tell you the criticality of keeping your app up to date with international data and security compliances. These include:

- General Data Protection Regulation (GDPR)

- Fintech Action Plan (FAP)

- Anti-money laundering (AML)

- Electronic Fund Transfer Act (EFTA)

- Electronic Identification and Trust Services (eIDAS)

- Federal Trade Commission (FTC)

- Securities And Exchange Commission (SEC)

- Payment Services Directive (PSD)

4. How Does A Fintech App Make Money?

After fintech app development, you can use the following monetization strategies to build revenue.

- Premium Services

- In-App Purchases

- Subscriptions

- Transaction Fee

- A Completely Paid Module

- Payment Processing Fee

- Lending

- Cryptocurrencies

So if you have any idea that you want to implement with the right blend of technologies and features and functionalities, then you can contact us or drop a query below.

And there you have it. Thank you for reading.

Also Read:

How To Create A Dating App? (Features, Cost, Time, and Lots More)

Build Your Own Uber App in 2021: A Comprehensive Guide

How To Converts iOS App to Android App? (Steps, Cost, and Challenges)

Tips and Strategies To Outsource Mobile App Development Services

Develop A Food Delivery Application (It’s Features, Cost, and Functionality)

Shopify vs WooCommerce vs Magento — Which eCommerce Solution Should You Choose For Your Business?

More content at plainenglish.io. Sign up for our free weekly newsletter here.